Introduction

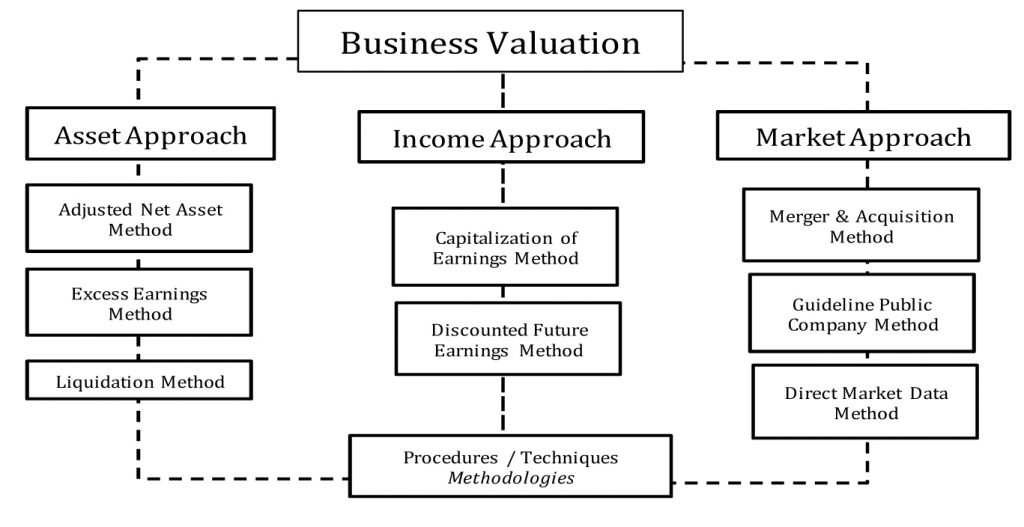

Business Valuation is the process of valuing a company on the basis of its history, brand and any relevant information related to it. Business valuation can be described as the process or result of determining the economic value of a company.

Business valuation is distinct from stock valuation, which is about calculating the theoretical values of listed companies and their stocks, for the purposes of share trading and investment management. This distinction extends to the use of the results: stock investors intend to profit from price movement, whereas a business owner is focused on the enterprise as a total, going concern.

Business Valuation Methods

Market Value Valuation Method

The market value business valuation formula is perhaps the most subjective approach to measuring a business’s worth. This method determines the value of your business by comparing it to similar businesses that have sold. It is a form of relative valuation and is frequently used in the industry. It includes Comparable Analysis and Precedent Transactions. This valuation method is a good preliminary approach to gain an understanding of what your business might be worth, but you’ll likely want to bring another, more calculated approach to the negotiation table.

Asset-Based Valuation Method

You might use an asset-based business valuation method to determine what your company is worth. As the name suggests, this type of approach considers your business’s total net asset value, minus the value of its total liabilities, according to your balance sheet.

Businesses that plan to continue operating (i.e., not be liquidated) and not immediately sell any of their assets should use the going-concern approach to asset-based business valuation.

The liquidation value asset-based approach to valuation is based on the assumption that the business is finished and its assets will be liquidated.

ROI-Based Valuation Method

An ROI-based valuation method evaluates the value of your company based on your company’s profit and what kind of return on investment (ROI) an investor could potentially receive for buying into your business.

Discounted Cash Flow (DCF) Valuation Method

The discounted cash flow valuation method, also known as the income approach, for example, values a business based on its projected cash flow, adjusted (or discounted) to its present value. The DCF method can be particularly useful if your profits are not expected to remain consistent in the future.

A DCF analysis is performed by building a financial model in Excel and requires an extensive amount of detail and analysis. It is the most detailed of the three approaches and requires the most estimates and assumptions.

Book Value Valuation Method

Finally, the book value method calculates the value of your business at a given moment in time by looking at your balance sheet.

With this approach, your balance sheet is used to calculate the value of your equity—or total assets minus total liabilities—and this value represents your business’s worth.

Factors Affecting Valuation

In addition to using specific formulas to calculate your business value, it’s important to be well versed in a few key business areas.

- Tangible assets: Tangible assets include machinery, property and inventory. It’s easy to calculate the value of tangible assets.

- Intangible assets: Intangible assets include brand recognition, trademarks and patents. These assets can add tremendous value to a business, and you should have some idea of the monetary value of your intangible assets.

- Liabilities: Business liabilities, including any debts your business owes, factor into its valuation.

- Financial metrics: Is your business profitable? If so, what’s your annual profit? How much revenue does your business bring in? Know your financial statements inside and out, as potential investors or buyers will want to know about your financials.

Business valuation know-how

Remember the following when going through the business valuation process with an investor:

- When you are first given a valuation, ask for a higher valuation. Pushing back demonstrates that you’re confident in your business and a good negotiator. Of course, when pushing back, provide evidence and arguments as to why the valuation should be higher. According to Guy Kawasaki’s The Art of the Start, ask for a valuation that is 25% higher than the first offer.

- Take the money and get to work if the valuation is reasonable. In most cases, businesses either make more money than you dreamed or they do not work at all. Neither the valuation nor the investor’s specific percentage will significantly affect the company’s ultimate success.

- Talk to your advisors, board members, consultants and other industry players to determine if the deal you’re getting reflects current valuations.

- Consider taking a lower valuation from the “better” investor, if you think that one investor brings more to the table than another.

Conclusion

Overall, it’s safe to say that one approach isn’t necessarily better than another, instead, the best assessment of your company will likely come as a result of combining multiple business valuation methods.