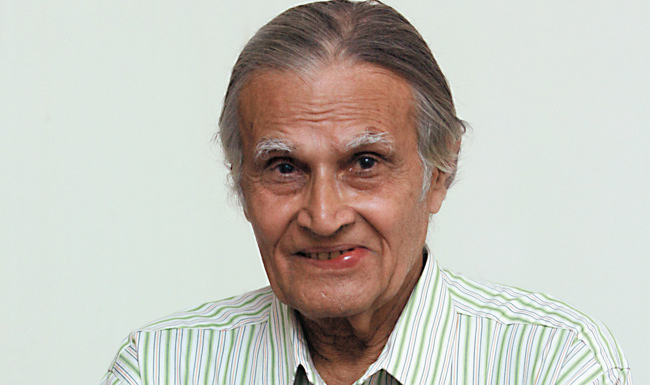

Veteran Chandrakant Sampat passed away at the age of 86 in Mumbai in 2015. He was known as India’s Original Value Investor. Chandrakant Sampat’s investment philosophy was straightforward. He advised investors to keep expenses low and invest in a few companies.

In the 1950s, he quit his family business after he was fascinated with the world of stock markets and investments.

Chandrakant Sampat is an inspiration to investors in India. He said that understanding the stock markets is not very difficult. One just needs a pen and chequebook. Chandrakant Sampat’s investment philosophy was to invest in companies that are in business and even uneducated people could understand. Additionally, companies with little debt, good RoCE (Return on Capital Employed), good track record of dividend payout, and less capital expenditure are investable.

Chandrakant Sampat invested majorly in FMCG giants like Hindustan Unilever (HUL), Nestle, Colgate, Indian Shaving Products (Gillette), etc., after they went public. The investments were for a long period. Moreover, he held these stocks for such a long time that after dividend payouts and bonus shares, the average cost became almost negligible. He also believed that mistakes and markets are the best sources of knowledge.

Talking about Chandrakant Sampat’s personal life, he prioritized fitness and health. Moreover, he was a regular jogger and was health-conscious. He followed a simple diet and avoided junk food. He believed in self-education and condemned the social system and traditional ways of education. However, he believed this thought restricted him. He was also a follower of the Bhagwad Gita and often quoted shlokas from it.

Follower of Peter F Drucker

Chandrakant Sampat’s greatest inspiration was Peter F Drucker. He also quoted him many times. Moreover, he used to agree and follow the theories and philosophies of Drucker.

He believed in Drucker’s perspective that if one achieves profits at the cost of downgrading and in companies without any innovation, then they are not profits. It simply means that one is destroying capital. Invest in companies which are continuously improving productivity and are focusing on innovations.

Chandrakant Sampat’s golden rule of investment

Studying a company’s fundamentals before investing is the reason behind the high success rate of Sampat. Moreover, he followed his investment principles religiously, helping him to stay ahead of his peers. Even today, modern investors follow Chandrakant Sampat’s investment philosophy to build multi-bagger portfolios.

Businesses with little debt

Sampat gave importance to two things. Firstly, free cash flow and secondly, the longevity of a business to create wealth. He also advises investors to invest in companies with little or no debt. Moreover, one should invest in companies that they know about. Additionally, one show checks whether the P/E ratio of the shares is around 13 to 14 times the current year’s earnings. Lastly, one should also check whether the shares are available between 3.5 to 4% yield.

Choose companies with a good management team

Chandrakant Sampat believed that investors should pick shares of a company that has a good management team. Moreover, one should invest in shares when they are at their eight or ten-year low. One can also invest in companies which are 40% lower than their 52-week high. Moreover, invest in companies which have little capital expenditure and the RoCE is not less than 25%.

Fewer Expenses

Chandrakant Sampat’s investment philosophy was to keep expenses low and have faith in the power of compounding.

During Bearish Markets

In the latter part of Sampat’s investment journey, he turned bearish on the market and invested in cash or cash equivalent instruments. There was a time when 70% of his net worth was in equities. He stayed away from stock markets deliberately because of global market policies that led to a rise in asset prices. Additionally, he was also disappointed with the corporate governance policies of Indian companies. He was not so confident about the performance of the Indian economy and corporate sector. Moreover, India’s fiscal deficit was rising and the scarcity of valuable investment options was missing. Many listed companies had negative EVA (economic value added).

Technology Acceleration: a threat to capital markets

The global threat of the accelerating rate of technology worried Chandrakant Sampat. He believed that it is a threat to the survival of capital markets. According to Sampat, technological innovations led to short business cycles. Therefore, the life span of companies will also reduce.

He believed that to cope with the technology boom, companies need to generate cash flows to ensure that they are prepared for any new technology development. This could change the way businesses used to work. According to Sampat, the diversion of funds towards technology leaves less or no space for capital formation. Moreover, companies with outdated technology will fail to survive. Hence, such an event could wreck the capital markets.

Conclusion

To sum up, Chandrakant Sampat’s investment philosophy was to invest in multi-bagger companies with less debt and capital expenditure, regular dividend payments, and strong fundamentals. Moreover, he followed a long term investment strategy with low expenses. Also, he had faith in the power of compounding. In his investment journey, he used to pick up stocks before other investors could realize the true value of the company.

Even the best-known investors on Dalal Street followed Chandrakant Sampat’s views without giving a second thought, given his years of experience and success in the stock market. One of the best investors in the Indian stock market, Radhakishan Damani, the founder of DMart, was a follower of Chandrakant Sampat’s investment philosophy.

Chandrakant Sampat used to study a business and then let the power of compounding do the rest. He followed a simple philosophy and earned a handful amount of revenue over the years. He also advised the Bombay Stock Exchange (BSE) to charge a listing fee, according to the number of shares the company was planning to issue, instead of a flat fee. Hence, whenever a company raises money via IPO or announced bonus issue, BSE would earn additional income.

Moreover, FMGC companies dominated his portfolio. But in the last years of his investment journey, he stopped investing. He disapproved of the ways of aggressive management where promoters focused on enriching themselves without providing benefits to the minority shareholders.