Introduction

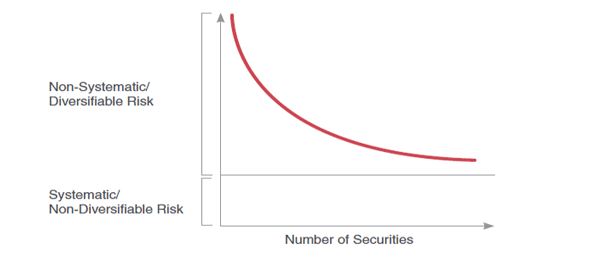

Diworsification is the process of making any investments which are not in sync with any other investment in the portfolio. It is also somewhere an overdoing in the diversification of any portfolio. The goal of portfolio diversification is to reduce volatility – owning assets that don’t always move in sync with one another. By diversifying, one loses the chance of having invested solely in the single asset that comes out best, but one also avoids having invested solely in the asset that comes out worst.

Diworsification is opposite to Markovitz’s nobel prize winning Modern Portfolio Theory (MPT), which preaches that optimal portfolios for a given level of risk and return can be achieved by diversifying across various asset classes and investments with different risk and return characteristics by analyzing how assets interact with each other. The term diworsification was coined by Peter Lynch in his 1989 book, “One Up On Wall Street”. He used the term to lament that some companies expand into areas widely different from their core business, ultimately to their detriment.

Diworsification is a concept that is inverse to modern portfolio theory, which helps investors to define an optimal allocation of individual securities across a portfolio, giving investors the best possible return level for the risk that they take on. Modern portfolio theory, however, requires substantial resources, data access, and monitoring, which is not always readily available for individual investment portfolios, where diworsification occurs the most.

Some factors of diworsification include impulse investing, style drift and generally favoring a particular sector. With impulse investing and sector overweighting, investors overweight their portfolios based on impulse investing tips or high expectations for a specific sector.

The smartest capital investment decision might be to repurchase the company’s own shares if higher returns cannot be found elsewhere. For businesses with a strong economic moat that is not easily replicated or expanded, share repurchases can often be the best capital allocation decision.

Diversification

Diversification is part of an investment strategy, but not one unto itself. In order to not repeat the mistakes made in the past, now is the time for investors to get off the pie chart merry-go-round and go back to financial basics by establishing a time-tested investment strategy. In portfolio management, diworsification relates to owning an excessive number of stock positions for the sake of diversification. This can lead to suboptimal investment decisions being made which lower the expected return of the portfolio.

It’s hard to argue with the common sense behind diversification within the investment process. To avoid losing our financial nest egg in a disastrous event from a single investment (i.e., bankruptcy), we spread our money around into different stocks, bonds, commodities and real estate holdings.

- Investors need to measure the efficiency & effectiveness of the investment mix within their portfolio.

- Large portfolios should stick with direct investments.

- Avoid actively managed bond funds. Avoid overseas investments.

Risk management through diversification is an extremely important discipline. Allocating funds across traditional asset classes like stocks, bonds, real estate and cash means that investors are not “putting all their eggs in one basket” for the inevitable periods of volatility and price declines. However, the most popular trend over the last ten years, particularly

after the 2008 recession, has been to over-diversify, or “diworsify,” portfolios.

Warren Buffet’s concentrated portfolio in his early days is a good example of avoiding diworsification. Although he was overly exposed to a small number of companies, he did thorough homework on each investment and reduced his risk (but increased his return!) by knowing each business he was invested in inside and out.

Signs of Diworsification

1. You own too many unit trusts within any single investment style category

Investing in more than one unit trust within any style category adds investment costs, increases required investment due diligence, and generally reduces the rate of diversification achieved by holding multiple positions.

Some unit trusts with very different names can be quite similar with regard to their investment holdings and overall strategy. To help investors sift through the marketing hype, the Association for Savings and Investment SA has unit trust fund-style categories that group together unit trusts with fundamentally similar investment holdings and strategies. Cross-referencing the unit trust fund-style categories with the different unit trusts in your portfolio is a simple way to identify whether you own too many investments with similar risks.

2. You own an excessive number of individual stock positions

Too many individual stock positions can lead to enormous amounts of required due diligence, a complicated tax situation and performance that simply mimics an index, albeit at a higher cost. A widely accepted rule of thumb is that it takes about 20 to 30 different companies to adequately diversify your stock portfolio. However, there is no clear consensus on this number.

Regardless of an investor’s magic number of stocks, a diversified portfolio should be invested in companies across different industry groups and should match the investor’s overall investment philosophy.

3. You own privately held ‘non-traded’ investments that are not fundamentally different from the publicly traded ones you already own

Non-publicly traded investment products are often promoted for their price stability and diversification benefits relative to their publicly traded peers. While these alternative investments can provide you with diversification, their investment risks may be understated by the complex and irregular methods used to value them.

Conclusion

While some diversification is prudent, investors should remember to focus on owning the best businesses with the largest potential returns within their risk tolerance and investment style.