Despite the thrill of travelling abroad, keeping track of your finances when you are away from home is essential. Your trip budget can take a hit if you use conventional payment methods like debit or credit cards due to the foreign currency markup expenses. Foreign exchange cards, often known as forex cards, are an easy and cheap method to deal in foreign currencies. Here, we’ll review how currency cards may be helpful, their benefits, and the most significant choices that international travellers visiting India can discover. Find the perfect Forex cards for international travel in India with our comprehensive guide.

Top 10 Forex Cards for International Travel in India

Understanding Forex Cards

Before setting out on a trip, tourists may fill their foreign exchange cards with a particular currency. When compared to more conventional forms of payment, they provide various benefits:

Safety and Security: Forex cards with chip technology and PIN security features are a better option for carrying large amounts of cash. Fortunately, most foreign exchange cards include a feature that lets you deactivate the card and get a new one in case of loss or theft.

Currency Management: You may load many different currencies onto one Forex card, which is a tremendous convenience for purchasing in other countries. This feature allows travellers to avoid carrying around several currencies or having to convert them at each stop, making it ideal for travellers visiting many destinations simultaneously.

Cost-Effectiveness: Using a Forex card offers convenience and security and helps protect your holiday budget from the dreaded foreign currency markup. The transaction costs for these cards are often cheaper than those for debit or credit cards. Moreover, many foreign exchange cards don’t charge forex markup fees, significantly reducing the overall cost of your overseas transactions. It’s an innovative and cost-effective choice for your travel finances.

Convenience: With a Forex card, you may make purchases and cash withdrawals with unrivalled ease when you go overseas. It’s an excellent method for keeping track of your money and making your trips more enjoyable. With this approach, you won’t need to worry about dealing with foreign exchange offices or carrying large sums of cash.

Reloadable: If you’re travelling with a Forex card, you can load up your balance whenever necessary, so you’ll always have money. You may load money onto your currency card in various ways, such as cash, internet transfers, or mobile banking, making managing it exceptionally straightforward. Hiring a seasoned professional allows you to thoroughly enjoy your activities without worrying about money. It will enhance your trip experience with pleasure and peace.

Transaction Tracking: Online accounts, transaction emails, and SMS alerts provide users with the extra convenience of readily tracking their costs while using Forex cards. Travellers who are good with money may keep track of their spending and stay within their allotted amount.

Top 10 Forex Cards in India

Now that we’ve covered why forex cards are a good idea let’s have a look at the top 10 options for international travellers visiting India:

Niyo Global Card by Equitas Bank

With the Niyo Global Card, you can save foreign exchange markup fees, access 130+ currencies, and use international lounges. It also comes with a digital savings account that gives you a decent rate of return and simple software that can locate any ATM on the planet.

BookMyForex YES Bank Forex Card

Consider the YES Bank co-branded credit card for its financial perks. You can pay in fourteen different currencies without incurring any foreign currency markup costs. Plus, when spending over INR 1,000, you become eligible for discounts at participating restaurants, a free international SIM card, and insurance.

Axis Bank Multi-Currency Forex Card

This card supports sixteen currencies, offers cash back on overseas roaming packs, and offers 24/7 emergency assistance. It allows users to load several currencies simultaneously and provides additional travel help services.

Standard Chartered Forex Card

This card, which can store up to twenty different currencies, is easy to apply for and maintain using the bank’s mobile app and online banking. Despite the 3.5% markup over base exchange rates, the extensive currency support makes it an enticing option for international travellers.

HDFC Bank Multicurrency Platinum ForexPlus Chip Card

You may use this card with 22 different currencies, and it comes with features like concierge and emergency support. A 2% cross-currency tax applies to all other currencies, but no markup expenses are associated with the loaded currency.

ICICI Bank Student Forex Prepaid Card

This card is a secure gateway to various advantages for international students, including insurance and zero liability protection. While it only works with US dollars and adds a 3.5% markup to any other currencies you use, its security features ensure your peace of mind, no matter where you are.

State Bank Multi-Currency Foreign Travel Card

With this card, you can manage your finances smartly. It’s usable in seven different currencies without a yearly fee and with only a minimal issuance charge. When using the loaded currency, there are no markup expenses. However, there is a 3% cross-currency use cost when using other currencies, ensuring you get the most out of your money.

Yes Bank Multicurrency Travel Card

This card allows you to purchase in fourteen different currencies. The issuance charge is INR 125, and the renewal price remains unchanged. This chip-based card and insurance coverage further protect those seeking a dependable alternative for international travel.

IndusInd Bank Multi-Currency Travel Card

You may use it to buy goods and services in fourteen different currencies, and the issuing charge is INR 300 (not including taxes). With features like travel advantages and complete insurance, it guarantees a peaceful trip.

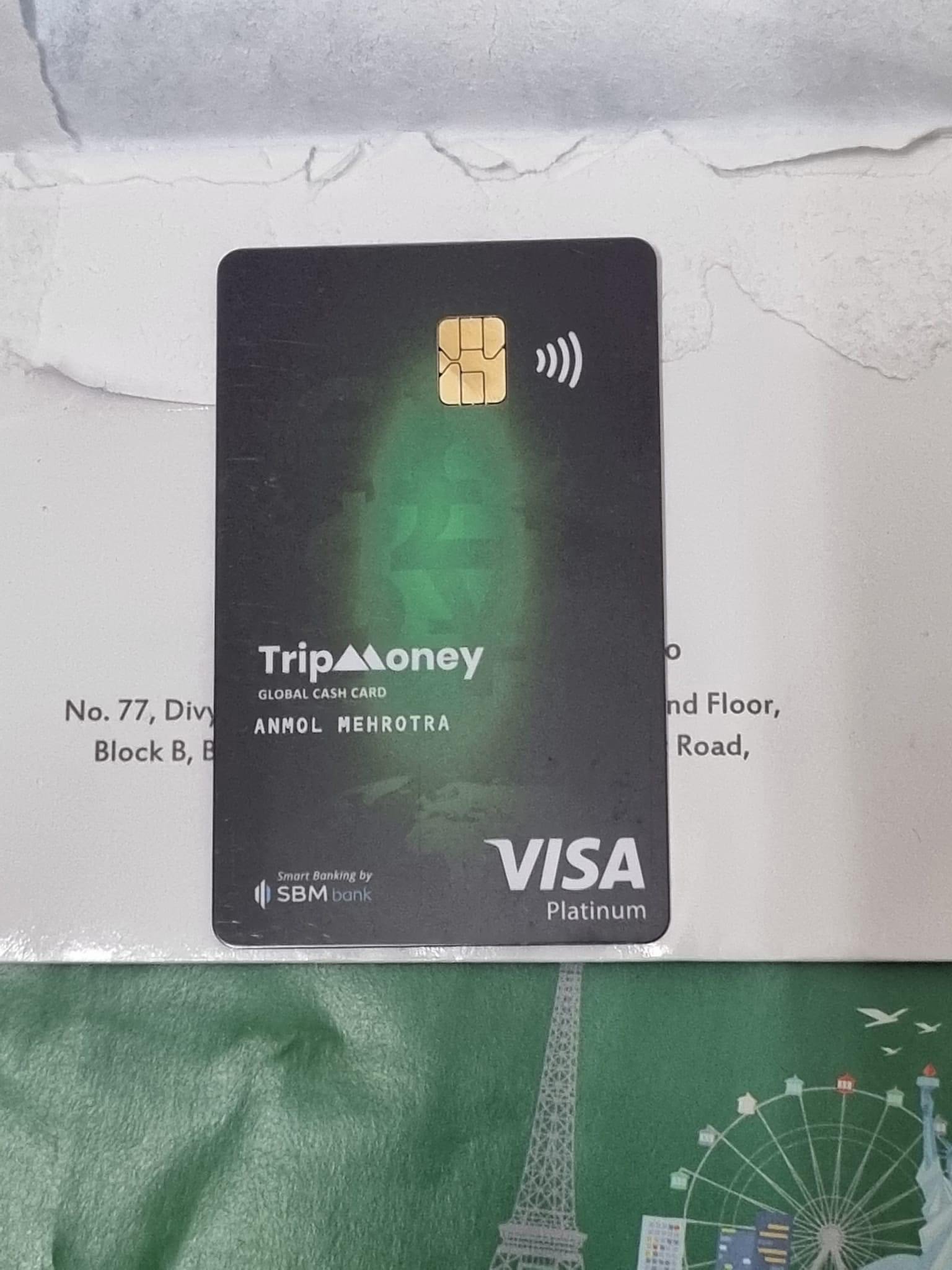

TripMoney Global Cash Card

This MakeMyTrip card’s issue price is INR 499 plus taxes and supports fifteen different currencies. It is the best option for regular flyers because of all the perks, such as a free MMT Black membership and huge savings on the MMT platform.

Introducing Scapia Federal Bank Credit Card

After combining Scapia Card and Federal Bank, a new competitor to traditional foreign exchange cards entered the market. This credit card’s innovative rewards program, unlimited use of domestic lounges, and absence of international transaction fees make it ideal for frequent fliers.

Conclusion

Using a Forex card is a simple, low-cost, and secure way to deal with foreign money. Since there are several options, travellers may choose a card that suits their needs. Several international payment options, such as the innovative Scapia Card and the currency-free Niyo Global Card, are available. If you want to unwind and enjoy your holiday, it’s essential to think of everything you’ll need before you book. Find the perfect Forex cards for international travel in India with our comprehensive guide.