Joan Robinson’s Model of Growth

Mrs. Joan Robinson has given her model of growth in her classic book. ‘The Accumulation of Capital in 1956. Joan Robinson’s model clearly takes the problem of population growth in a developing economy and analyses the influence of population on the role of capital accumulation and growth of output.

In the words of Prof. Mathew, The relation between distribution and growth in this model arises partly from the mutual interdependence of the rate of profit and the pace of capital accumulation and partly from the effect of distribution of income on the proportion of income saved.

Assumptions

1. Labour and capital are the only productive factors. It implies that the national output is the result of combined efforts of these two factors of production.

2. The economy is assumed to be closed i.e., there is no foreign trade.

3. Total wage bill is the product of real wage rate and number of workers.

4. Total income is divided between capital and labour as these are the two factors of production.The production is not affected by the technological changes i.e. there is no progress in technology.

6. Total profit is the product of profit rate and amount of capital invested.

7. There is constancy in price level.

8. Wage earners spend all of their wage income on consumption, while profit takers save and invest all of their profit income.

9. Capital and labor are combined in a fixed proportion for a given output.

10. The national income is the sum of wage bill and total profits.

11. There is no scarcity of labor and entrepreneurs can employ as much labor as they wish.

12. Entrepreneurs consume nothing but save and invest their entire income for capital formation. If they have no profits, there is no accumulation and if they do not accumulate, they have no profits.

Open Model

In an open economy, the conditions for the steady growth and conditions for rising rate of capital accumulation will be discussed. According to Mrs. Joan Robinson, national income is the sum of the total wage bill and total profit. Total wage bill is the real wage multiplied by the number of workers and total profits are equal to profit rate multiplied by the amount of capital. This relationship can be expressed as under:

PY = WN + πPK

Where P = Average Price level.

Y = Net national income.

W=Net money wage rate.

N=Amount of labor employed.

K=Amount of capital invested.

π =Rate of profit.

To convert the expression into real terms, divide both sides of equation by p (average price level), we get

Where ρ Y/N i. e Labor/ Productivity,

W/P real wage rate

θ = K/N i.e., Capital Labour Ratio

The above equation indicates that the profit rate is a function of labour productivity (p) and real wage rate (W/P) and capital labour ratio (8). In other words, the profit rate is shown as capable of varying directly with the rate of net return to capital and inversely with the coefficient of capital intensity. The necessary condition for maximization is that the first derivative must be zero.

Keynesian income expenditure analysis shows that the net national real income (Y) is the sum of real consumption expenditure (C) and real net investment which can be expressed as;

Y = C + I

Now we know that labour spends its entire income and saves nothing. The profit earning class makes saving in the form of profit. According to Mrs. Robinson, savings must be equal to total profits. Thus, savings in a given period are equal to capital investment multiplied by rate of profit.

The above equation illustrates that the rate of growth of capital is capable of increasing if the net returns to capital rise in greater proportion than the capital-labour ratio and vice-versa. In other words, lower rate of profit always affects the supply of capital adversely which in turn widens the gap between supply of capital and labour. The main feature of the model is that the rate of growth of capital is dependent on profit rate.

Closed Model

In a closed economy, the concepts of Golden age and Platinum age are to be discussed. In simple words, Golden age is a situation of smooth steady growth with full employment arising out of the equality of the ‘Desired’ and ‘Possible’ rates of accumulation and has been designated by Mrs. Joan Robinson as the Golden age equilibrium.

However, if an increase in labour supply is not accompanied by proportionate increase in the capital supply, then it will cause unemployment in the economy. To achieve full employment of labour the growth rate of population must be equal to growth rate of capital i.e.

∆N/N = ∆K/K

When the rate of growth of labour and capital are equal to each other, then there is full utilisation of capital in the economy. Such a switch on is called Golden age. The existence of Golden age is the indicator of full employment level.The concept of Golden age implies that there must be equality in actual, warranted and natural growth rates.

In short, in Mrs. Robinson Joan’s words, when technical progress is neutral and proceeding steady, without any change in the time pattern of production, the competitive mechanism works freely, population grows (if at all) at a steady rate and accumulation goes on fast enough to supply productive capacity for all available labour, the rate of profit tends to be constant and the level of real wages rises with output per head.

Then there are no internal contradictions in thesystem, we may describe these conditions as a Golden age (thus indicating that it represents a mythical state of affairs not likely to obtain in any actual economy).

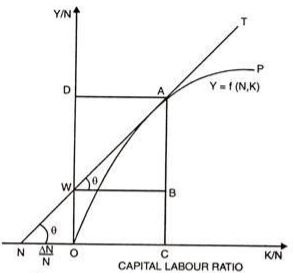

Capital labour ratio is illustrated along positive direction of X-axis and wage rate of labour on Y-axis and the growth rate of labour on negative side of X-axis. The production function is represented by OP.

Each point on this curve shows the proportion in which capital and labour are combined to produce a particular level of output.Tangent NT touches the curve OP at A and intersects Y-axis at W. At point A capital labour ratio is OC, the productivity of labour is OD and out of which OW is the wage rate. The surplus DW is rate of return to capital.

The point A shows the position of equilibrium because the slope of tangent NT and the slope of production curve OP is the same. It can also be said that at A, the growth rate of capital ∆K/K is equal to growth rate of labour ∆N/N.

(i) ∆N/N˃ ∆K/K

(ii) ∆K/K ˃ ∆K/ A

The first possibility (i.e., ∆N/N ˃ ∆K/ K) shows that the growth rate of population is greater than growth rate of capital. This type of situation occurs in underdeveloped countries. Mrs. Robinson is of the view that it is the ‘profit wage relation’ which pushes the economy back on the path of Golden age. The excess of labour supply would depress the money wage rate and if the prices remain constant, the real wages would fall.This fall in real wages would increase the level of profit, which in turn would stimulate the growth of capital.

The increase in the growth rate is unable to fulfil the labour supply of population. When the parity between the two growth rates are restored, then the economy would be on Golden age.

On the other hand, if real wages do not fall because of subsistence wage floor or if the general price level does not fall in same proportion as money wage rate, it would be difficult to restore the position of Golden age and it will lead to under employment.

2. The second possibility comes out as the economy is in the disequilibrium and can be expressed as ∆N/N ˂ ∆K/K, Under the situation, the growth rate of population is less as compared to growth rate of capital. This type of situation occurs in developed countries. The possibility of advanced countries returning to the path of Golden age equilibrium is greater than that of underdeveloped economies.

Conclusion

In golden age, the initial conditions are appropriate to steady growth. In limping golden ages, the actual realization growth rate is limited only by the desired rate.

In a bastard golden age, the possible rate is limited in a different way i.e., by real wages at the tolerable minimum. Both in a limping golden age and a bastard golden age, the stock of capital in existence at any moment is less than sufficient to offer employment to all available labour. In the limping golden age, the stock of equipment is not growing faster for lack of animal spirits.

In a restrained golden age, the realised growth rate is limited by the possible rate and

kept down to it. In the bastard age, it is not growing faster because it is blocked by inflation barrier. In platinum ages, the initial conditions do not permit steady growth and the rate of accumulation is accelerating or decelerating as the case may be.