Introduction

Assets like home loans, bills of exchange, overdrafts, or cash credit get classified as non-performing when the principal or interest payment remains outstanding for more than 90 days. Assets are of two types- Standard Assets and Non-Performing Assets (NPAs). Based on the default period, there are three types of non-performing assets- Substandard, Doubtful, and Loss Assets. Moreover, as per the RBI guidelines, there are two types of non-performing assets on banks’ balance sheets- Gross NPAs and Net NPAs.

Two factors cause NPAs:

- Internal Factors (caused due to the borrowers and banks):

- Firstly, the borrower does not use the loan or borrowed amount for productive purposes, and hence there is no income generation.

- Secondly, delays in the project lead to the loss of borrowers.

- Thirdly, poor recovery of funds from debtors.

- Then, fund diversion for growth and expansion purposes, helping subsidiaries, funding new projects, etc.

- Further, business failures and losses.

- Inability to raise funds from capital markets.

- Misappropriation of funds, willful defaults, frauds, etc.

- Lastly, deficiency from the point of view of banks. For instance, lack of follow-ups, monitoring, credit appraisal (loans sanctioned without credit rating), settlement of payments, etc.

- External Factors:

- Incompetent and complicated legal system.

- Industrial or global recession, payment failures to other countries, natural calamities, adverse exchange rates, etc.

- Raw materials and resources.

- Fluctuations in government policies.

Types of non-performing assets according to the tenure of default

Assets that provide principal and interest payments on a timely basis are known as Standard or Performing Assets. But even if a person defaults up to 90 days, it is known as Standard Assets. For example, if a person pays EMIs with interest regularly but if he defaults on the payment for one month, then these assets are categorized as Standard Assets as the default is still up to 90 days. Moreover, banks create a general provision/ RDD of 0.4% for Standard Assets (specifically for agriculture and MSME loans, the provision is 0.25% and 2% for housing loans).

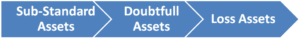

As mentioned earlier, defaults in loan repayments for more than 90 days are known as non-performing assets. There are three types of non-performing assets:

- Substandard Assets- Substandard Assets are assets that default for more than 90 days but up to 12 months. Moreover, banks need to create a provision/RDD of 25% for these assets.

- Doubtful Assets- Doubtful assets are assets that default for more than 12 months. Further, there are three levels of doubtful assets:

a. Level 1- When assets default for up to 12 months. Moreover, banks need to create a provision/RDD of 25% for these assets.

b. Level 2- When assets default for more than 12 months but up to three years. Moreover, banks need to create a provision/RDD of 40% for these assets.

c. Level 3- When assets default for more than three years. Moreover, banks need to create a provision/RDD of 100% for these assets.

3. Loss Assets- When assets become non-recoverable, they are known as Loss Assets. Banks need to create a provision/RDD of 100% for these assets.

Additionally, for unsecured assets, without any collateral security, the RDD is 100%, irrespective of the default period.

Types of non-performing assets according to RBI:

There are two types of non-performing assets according to RBI guidelines in the balance sheet of banks.

- Gross NPA- Gross NPA is the total of loan assets, including substandard, doubtful, and loss assets. It reveals the quality of loans.

Gross NPA ratio= Gross NPA/Gross Advances

Here, Gross NPA= Substandard + Doubtful + Loss Assets

Gross Advances= Standard+ Substandard + Doubtful + Loss Assets (i.e., Standard + NPA)

- Net NPA- Net NPA is gross NPA minus provisions. It reveals the actual burden of the banks. The write-offs and recovery process is time-consuming. Hence, banks have to make provisions as per RBI guidelines to cover the anticipated losses that may arise in the future.

Net NPA ratio= Gross NPA – Provisions/Gross Advances – Provisions Asset Classification

Strategies to manage non-performing assets

RBI and government of India have suggested measures to manage high levels of NPAs.

Debt Recovery Tribunal (DRT)

Before the formation of DRT, normal courts used to solve cases related to the recovery of NPAs, which was time-consuming. Therefore, in 1993 the Government of India passed a bill to set up Debt Recovery Tribunals for faster recovery of loans legally and effectively. They focused on solving cases related to the recovery of default loans and payments. Later, in 2000, amendments were made to the DRT Act to provide necessary powers to the tribunal.

Asset Resolution Companies (ARCs)

RBI allowed the formation of asset reconstruction companies (ARCs). Instead of charging the promoters for restructuring of loans, they come up with a measure to revive the company. They are specialized companies appointed by the banks. Many banks come together and form such companies to recover the default amount via changes in management or liquidation. Liquidation means selling the company’s assets so that they are in a position to pay off its debts.

The Securitization Act

In 2002, the government passed the Securitization and Reconstruction of Financial Assets and Reinforcement Act. The act gave commercial banks the power to deal with NPAs- confiscating the borrower’s assets, taking over the management of the secured assets, realizing defaulter’s receivables, and appointing managers to handle the affairs of the borrowing unit to recover default amounts.

Prompt Corrective Action (PCA)

RBI came up with a PCA mechanism for the banks that do not follow the NPA norms. High NPAs of a bank invites supervisory action of RBI. PCA is of two types:

- Mandatory Actions- Firstly, banks need to take special measures to reduce the stock of NPAs and control the new ones. Secondly, they need to review and upgrade their loan policies from time to time. Thirdly, strengthen measures to follow up on loans like sending letters, reminders, warnings, etc. Also, banks need to look after the follow up of cases in courts and tribunals. Moreover, they need to have a proper credit management mechanism within the bank where they should do a proper study of borrower’s financial history, etc. Lastly, they should reduce concentration on loans and focus on investments in different avenues like cash credit, overdraft, etc. where default risk is less as compared to term loans.

- Discretionary Actions- Firstly, banks need prior approval from RBI before opening a new bank branch or starting a new business line. Secondly, if the banks have high NPA levels, they should reduce the dividend to shareholders and utilize the amount to cover up NPAs. Lastly, banks should reduce their shareholding in subsidiaries having high levels of NPAs.

Corporate Debt Restructuring (CDR)

In 2001, the government came up with the CDR mechanism. It is a mechanism for restructuring the debts of viable business units outside the purview of DRT and other legal proceedings. Measures like debt-for-equity swap are taken up where creditors accept shares of a distressed company, and in exchange, they let go of some or all of its debt.