The strong momentum in stocks after the dip in 2020 is stunning in terms of its pace and connectivity. Very few stock markets rallies have lasted for such a long time without any meaningful corrections. Valuations are not at all disappointing the investors as they reflect the expectations of the businesses.

Mutual fund managers favour a basket of stocks. The managers have been holding these seven stocks since September 2020.

How were the stocks identified?

- Firstly, the managers identified the BSE 500 stocks, which saw an increase in holdings by mutual funds in the past four quarters.

- Out of 497 companies whose shareholding data was available, managers considered 46 stocks.

- Then whichever stocks had at least 5% of the mutual fund company share capital and at least 20 schemes held them as of September 2021 were selected.

- The list came down to 20 stocks when the managers selected only equity schemes and ignored sectoral and hybrid funds.

- Further, they considered those stocks having a Return of Equity (ROE) of at least 15% over the past 3 years, which brought down the list to 10.

- Lastly, three out of the ten companies faced corporate governance and regulatory issues, leaving the managers with seven most wanted stocks.

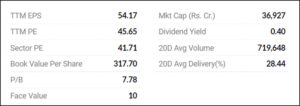

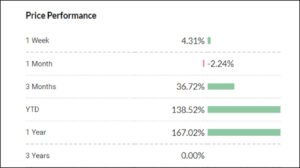

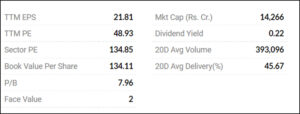

Stock 1: Polycab India

Polycab is the leader in the organized cable and wires segment. Even though it faced a weak June quarter, it outperformed in the FMEG (fast-moving electrical goods) space due to the brand presence and strong distributor network.

The company launched Project Leap, intending to earn ₹ 20,000 crores in revenue in the next five years and renovate its business processes.

The sector is in consolidation. Faster growth in B2B and dominance in the B2C segment will help to achieve the target. It should also focus on increasing retail wires through distribution and product range.

To enhance its innovative capacity, the company acquired a technology company. It will show a shift from cyclical to an electrical behemoth.

The analysts upgraded the rating to BUY from HOLD because of the strong earnings of the company.

Stock 2: Orient Electric

Despite the falling demand for white goods, the environmental factor remains steady for all the investors, and it will pick up soon. Orient Electric, an electric appliance company, recorded strong earnings. The inventory is higher than expected, but the company remains net cash positive. The company has estimated that the working capital will stabilize in the next two quarters.

It performs well in both economy and premium segments. With the increase in commodity prices, the company has also raised the price and has developed cost-saving programs.

The main expense is high employee costs and ad spending as a percentage of sales. If the company manages to sustain and grow, then it can have solid operating leverage. It will witness a robust margin expansion when the economic recovery speeds up.

Analysts maintain a BUY rating because of their strong manufacturing and distribution capabilities. The demand is scaling back due to the festive season.

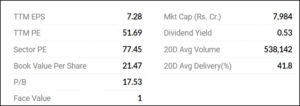

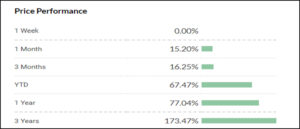

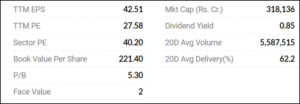

Stock 3: SBI Cards & Payments Services

SBI Cards, credit card issuer, has the second-largest market share in India after HDFC Bank. It partners with SBI to get an exposure of 22,000 branches and a customer base of 440 million, providing a scalability potential. It has doubled its card base over the past three years.

The company has seen strong momentum in revenue growth and robust net interest margins. The CAGR is 40% from 2015 to 2020. The return on assets is 4% in 2020-21 despite the disastrous pandemic. There is a gradual pick up in credit card spending from June 2021, and it is likely to accelerate as economic activity and consumer sentiment improve.

The robust operating performance and healthy provisions will absorb credit costs without impacting the return ratios.

The unique business model of SBI Cards will help to generate superior ROE of 25% in the medium term (FY25), and it is the only potential listed player. Keeping all the points in mind, analysts maintain a BUY rating.

Stock 4: Radico Khaitan

Radico Khaitan is the largest Indian made foreign liquor (IMFL). It has generated and entered brand equity in the ‘Prestige and above’ liquor segment. It is India’s largest IMFL exporter and plans to set up local bottle units in foreign markets.

Its presence in the canteen store departments provides the brand with an upper hand in the whiskey category. The breweries maker has added two new luxury brands to its portfolio- Royal Ranthambore Heritage Collection Whisky and Magic Moments Dazzle Vodka. It will help the company to strengthen its market share.

The muted business activity during the pandemic affected the volumes, but the strong recovery witnessed in the recent quarters shows the resilience in premium brands demand.

Analysts have re-rated the company and maintained a BUY rating because of the market share gains, healthy launch of new product lines, strong balance sheet, superiority and improvised returns.

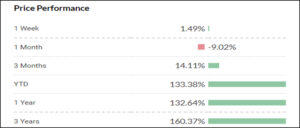

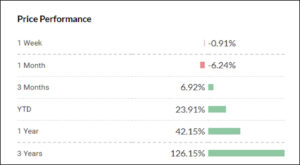

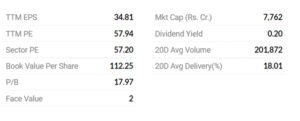

Stock 5: HCL Technologies

HCL Technologies, a software company continues to sign large deals in the cloud, digital and cybersecurity. In the September quarter, it had signed 13 contracts across healthcare, telecom, and manufacturing, total contract value amounting to $2.2 billion.

Revenue acceleration is because of the block deals and the robust demand.

There is a divergence between employee addition and revenue growth in the past four quarters. There is a proactive addition of 35,000 employees due to the supply side crunch.

Its Products and Platforms business has seen a muted business activity due to delays in deals, but it will pick up in the upcoming quarters.

It has revised its dividend payout policy, where it will distribute 75% of its net income in the form of the dividend until 2025-26. It will improve return metrics and boost total returns for investors.

Analysts maintain a strong BUY bet because of the deal wins, geographical expansions, investment capabilities, and estimated CAGR of 13.2%.

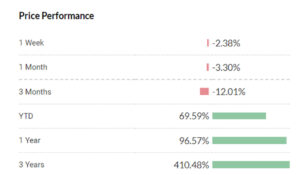

Stock 6: TCI Express

TCI Express is a B2B express logistics company with 800 plus pan-India centers and 40,000 pick-up and delivery points. It provides diversified offerings to pan-India such as cold chain express (for pharma sector), C2C (customer to customer) express, air express logistics, and is still building up.

It will invest 100 crores in the next two years to establish sorting centers in Gurgaon, Pune and warehouses all over India.

The company focuses on building up its B2B segment, SME and MSME clients, continuous investments in technology, etc., which provides a good customer experience, adds customer value and gives an upper edge over other competitors.

It also intends to automate its warehouses and provide innovative C2C services, express rail logistics, and investments in new geographies.

Analysts maintain a BUY rating as they expect the company to have consolidated EBITDA margins of over 20%.

Stock 7: Gujarat Gas

Recently, Gujarat Gas took a spike in prices in both LNG and CNG to pass on the corresponding rise in global and domestic gas prices, respectively. It shows that the company want to protect its margins.

It has shifted 20% of the input cost to lower cost of domestic gas from Vedanta and Reliance and 10% through half-priced contact LNG. Experts predict that the volatility in margins will reduce further.

The Nord Stream Pipeline 2 running from Russia to Germany could ease LNG prices. Gujarat Gas has the highest exposure in the industrial segment, and the volumes are the best compared to the gas distributors in the city.

It entered the lucrative CNG business in 2020-21 and now plans to add more stations in two years. It enjoys high profits with a ROE of 25%.

Looking at the opportunities that the company has been grabbing, the Analysts maintain a BUY bet.

Conclusion

Most of the stocks have elevated valuations. If the earning growth of companies does not meet the expectations, they can’t provide a cushion during the downside. Hence an investor should do their analysis and diligence before following the footsteps of the professional asset managers.