Section 194-IA deals with the deduction of TDS on purchase of a property by the buyer. When a buyer purchases an immovable property (a building or a part of a building or a plot of land other than agricultural land) which costs more than 50 lakhs, he should deduct TDS while paying to the seller. On transfer of the immovable property, the buyer must deduct 1% TDS at the time of credit or, at the time of payment in cash or by cheque or by any other mode to the seller, whichever is earlier.

The section was made applicable on 1st June 2013. TDS on purchase of a property is also deducted when an immovable property was purchased before 1st June 2013 but instalments have been paid after 1st June 2013.

Requirements during deduction of TDS on purchase of a property

- TDS on purchase of a property gets deducted when the sales consideration of the immovable property is equal to or more than 50 lakhs.

- The buyer has to deduct 1% TDS on the sale consideration.

- If payment is made in instalments, then TDS gets deducted on each instalment.

- ‘Consideration of immovable property’ includes all charges like car parking fee, membership fee, electricity facility fee, etc. All charges incidental to the transfer of immovable property are included.

- TDS gets deducted on the entire sale amount. For instance, Mr Ram purchases an immovable property from Mr Shyam at 90 lakhs. Now, TDS gets deducted on the entire 90 lakhs and not just on 40 lakhs (90-50 lakhs). Hence, the TDS amounts to ₹90,000. Another example, consider than My Shyam has paid two lakhs for water facility and three lakhs for parking. Therefore, the total sales amount is 95 lakhs. Hence, Mr Ram paid TDS of 1% on 95 lakhs which amounts to ₹95,000. If the transaction was carried out between 14th May 2020 to 31st March 2021, then the TDS rate would have been 0.75%.

- The buyer can make the payment of TDS on purchase of a property without having a TAN i.e., Tax Deduction Account Number.

- The buyer can use PAN for making payment of TDS on purchase of a property. PAN of both buyer and seller is mandatory or else the TDS gets deducted at 20%.

- One should use challan 26QB to pay TDS on immovable property. Also, one should pay the TDS amount within 30 days from the end of the month when TDS was deducted.

- Moreover, after paying the TDS to the government the buyer needs to obtain Form 16B and issue it to the seller.

Steps to pay TDS via challan 26QB and Form 16B

Step 1: Payment through challan 26QB (offline and online)

- Firstly, go on the official website of Tax Information Network and then click on services.

- Secondly, click on ‘e-payment: Pay Taxes Online’. A new window will open up with different challans.

- Next, go to TDS on Property (challan 26QB) and click on proceed button.

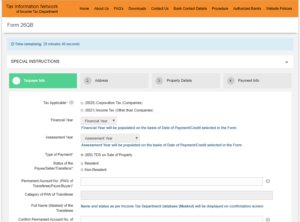

- A new screen will open which looks like the image below.

- Then, select code 0020 if one is a corporate taxpayer or code 0021 if a non-corporate taxpayer.

- After that, enter details like financial year, assessment year, type of payment, residential status, PAN of the buyer and seller, address of both parties, etc.

- Once all details get filled in all three tabs- taxpayer info, address, property details. Then, the last is ‘payment info’. There are two payment modes- e-tax payment immediately (via net banking) and e-tax payment on a subsequent date (visiting the bank branch). Click on anyone which is most preferred and then on ‘Proceed’.

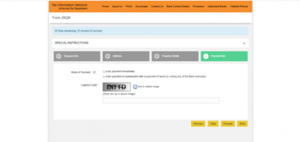

- If one chooses net banking, then one needs to login into their bank and pay online. After making the payment, the bank lets one print the Challan 280 with a tick on 800 (payment of TDS on purchase of a property). Print the challan.

- If one chooses offline mode, an online receipt for Form 26QB with a unique acknowledgement number gets generated. The number is valid for ten days from generation. One needs to take this to the authorized banks along with the cheque. Lastly, the bank proceeds with the online payment and generates one’s challan.

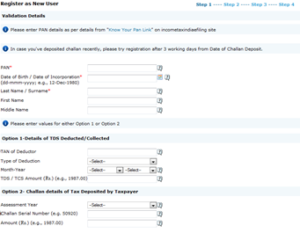

Step 2: Register in TRACES

- If one is a first-time user, register on TRACES with PAN number and challan number registered during the first payment. The objective of the facility is to enable taxpayers and deductors to view taxes paid online, for reconciliation purposes, and for seeking refunds.

- After registering, one can get approved Form 16B (TDS certificate) and then issue the Form to the seller.

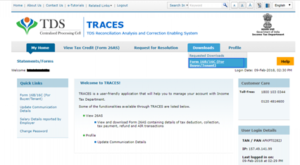

- Then, check the Form 26AS seven days after the payment. It gets reflected under ‘Details of Tax Deducted at Source on Sale of Immovable Property u/s 194(IA) [For Buyer of Property]’.

- Moreover, Part F provides details about the TDS certificate, name and PAN details, acknowledgement number, transaction amount and date, and TDS deposited.

Step 3: Download Form 16B

- After the payment reflection in Form 26AS, log in to TRACES.

- Then, go to the ‘Download’ tab and click on ‘Form-16B’ (for the buyer).

- Fill in PAN and acknowledgement number details. After that, click on Proceed.

- Further, verify all the documents and click on ‘Submit’.

- Once the request gets processed, click on Downloads and select ‘Requested Downloads’ from the drop-down menu.

- One can view that the status of the Form 16B download request as ‘Available’. Moreover, if the status shows ‘Submitted’ wait for a few more hours.

- Download the ‘zip file’. The password to open the zip file is the date of birth of the deductor (DDMMYYYY). It is available in pdf format. One can then take a printout.

Implications for non or late filing of TDS on purchase of a property

On the non or late filing of TDS on purchase of a property, a buyer might be liable to pay various interest, late fees, penalties etc.

- Firstly, in case of non-filing or late filing of Form 26QB a fee is applicable under section 234E which is ₹200 per day till the failure continues.

- Secondly, on non-deduction of TDS, an interest of 1% is chargeable per month and an interest of 1.5% is chargeable per month on non-remittance of TDS after deduction.

- Additionally, the assessing officer may levy a penalty under section 271H at his discretion. The penalty under this section is more than ₹10,000 but less than 1 lakh. But this penalty is not levied if the statement is submitted within one year.

Additionally, on non or late filing of Form 26QB, the seller will not be able to claim TDS credit.