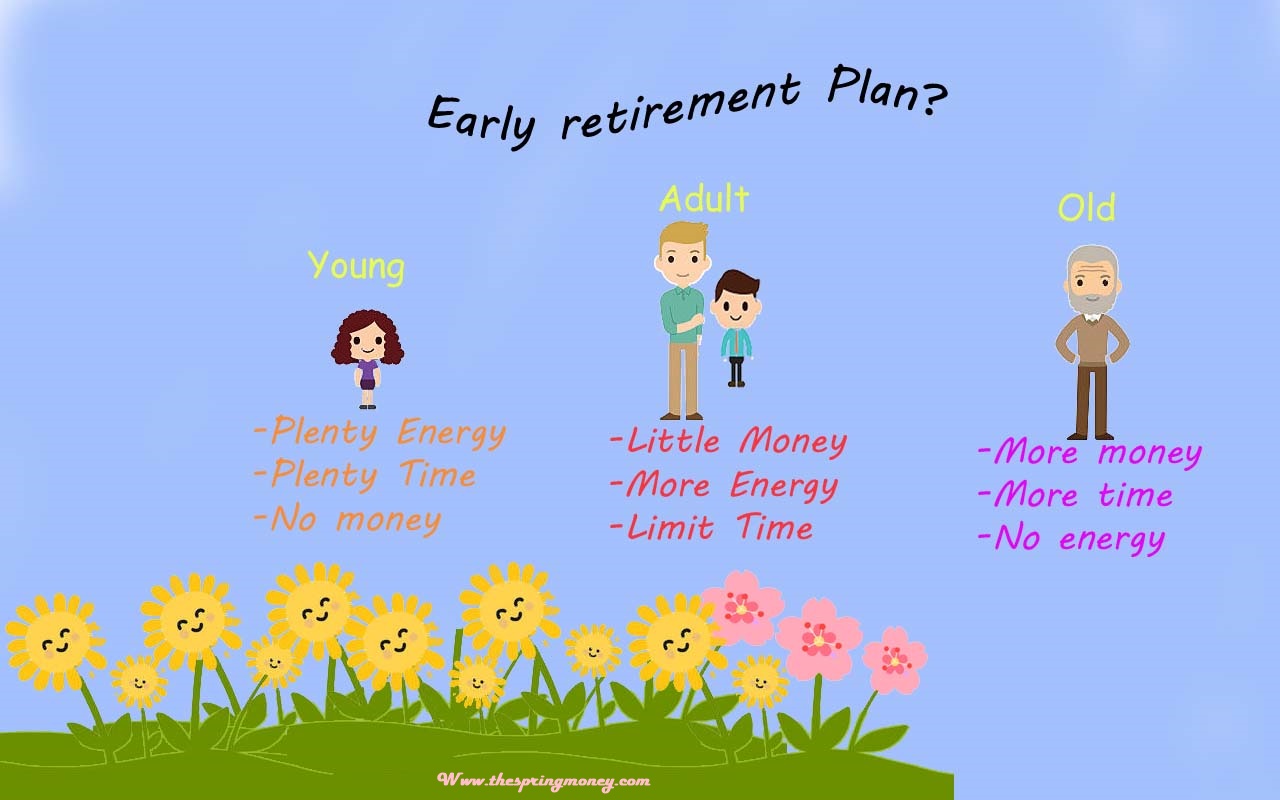

Many people want to retire and leave the daily grind of work behind to enjoy their golden years. This is a dream that many people share. The traditional retirement age is usually set at 65, but more and more people want to quit early and become financially independent. Planning for early retirement is a trip that requires careful planning and smart choices about money. To succeed, you must follow tips to plan for early retirement and set long-term goals. In this detailed guide, we’ll look at the five most important steps you need to take to plan for early retirement and set yourself up for a life of financial freedom and happiness. Use these tips to plan for early retirement and get on the road to financial freedom.

Define Your Retirement Goals

The first step in planning to retire early is to have a clear picture of your life when you stop working. Imagine your dream life after you stop working. Think about where you would like to live, the kind of life you want, and what you want to do. Consider trip plans, hobbies, charity work, and time with family and friends. Setting your retirement goals early on gives you a road map for your financial plan and clear goals to work towards.

Also, think about how long you expect to be retired. Early retirees often have longer retirements, which means they need to save more money to keep living the way they want to for years or even decades. Remembering this will help ensure your financial plan is strong enough to last.

Establish a Solid Financial Foundation

Before embarking on the path to early retirement, it is prudent to establish a solid financial foundation. First, you should have an emergency fund to cover your expenses for six to twelve months. This fund is intended to be used as a safety net in the event of a financial emergency, such as the need for medical care or the loss of a job. Your retirement savings will not need to be used.

Credit card debt and personal loans carry such high interest rates that you should avoid them at all costs. If you can pay off your debts, you will have more money for long-term goals such as saving and spending. Focus on debt repayment strategies that fit your budget and seek professional assistance if necessary.

Maximise Retirement Savings

Maximising your retirement funds is paramount if you want to retire early. Maximise your participation in employer-provided retirement plans like 401(k)s and 403(b)s by making the maximum annual contribution. These contributions reduce your taxable income since the money is donated before taxes are taken out. Employer matching contributions are effectively free money for your retirement, so it’s essential to contribute enough to earn the full match if possible.

Individual Retirement Accounts (IRAs) and Roth IRAs are alternatives to employer-provided retirement plans. Early retirees who expect to be in a higher tax band in retirement may find the tax-deferred growth offered by Traditional IRAs and the tax-free withdrawals offered by Roth IRAs especially attractive. Consider your retirement plans, tax position, and available options to maximise contributions.

Invest Wisely for Growth

Investing carefully is an essential part of any plan for retirement, especially for people who want to retire early. Even though saving money regularly is necessary, spending it wisely can give you the chance for higher returns and speed up your path to financial freedom.

Diversification is the best way to keep your business strategy from too risky. Put your money into different types of investments, such as stocks, bonds, real estate, and even commodities or private equity. Asset selection should be based on how comfortable you are with risk, your time, and your total financial goals.

It is essential for people who want to quit early to find a mix between risk and growth. Even though the stock market can be unpredictable, it has generally given better long-term results than more stable assets like bonds. But make sure that your financial plan fits how much risk you are willing to take and be ready for market changes without putting your long-term goals at risk.

If you don’t know much about saving, you should talk to a financial adviser. A trained expert can help you develop a personalised investment plan and ensure that your account is set up to get the best results while minimising risk.

Continuously Monitor and Adjust Your Plan

As you move towards early retirement, it is essential to keep an eye on your plan and make changes as needed. Life situations, financial markets, and personal goals can change over time, which could mean you need to change your retirement plan.

Review your investment account often to ensure it matches your risk tolerance and when you want to retire. Rebalance your portfolio every so often to keep the asset mix you want, and make sure that no single asset class takes over your investments.

Also, look at your retirement goals at least once a year and make any necessary changes based on how your vision or finances have changed. Check your planned retirement age, living dreams, and savings rate again to ensure you’re still on track to reach your early retirement goals.

Conclusion

Planning for an early retirement requires meticulous attention to detail, unwavering discipline, and a well-crafted strategy. By following these five tips to plan an early retirement—defining your retirement goals, establishing a solid financial foundation, maximising retirement savings, investing wisely for growth, and continuously monitoring and adjusting your plan—, you can set yourself on the path to achieving financial independence and retiring early.

Early retirement is an ambitious endeavour that requires commitment, sacrifice, and adaptability. The journey may be filled with challenges and unforeseen circumstances, but early retirement can become a reality with perseverance and prudent financial decisions. Embrace the sense of purpose that comes with planning for your future, and remember that pursuing financial independence is a journey worth taking. Ultimately, tips to plan an early retirement grant you the freedom to live on your terms, pursue your passions, and savour the joys of a well-deserved retirement.