Amazon, the company that has been referred to as “one of the most influential economic and cultural persons in the world”, is currently the world’s most valuable brand. What started as an online bookstore in 1994, has now grown into the most powerful industry that is known for its disruption of well-established industries through technological innovation and mass scale. We know Amazon as an online store, but it is so much more than that. It is one of the big five companies in the US IT industry along with Google, Apple, Facebook (Meta), and Microsoft. The reason behind the immense success lies in Amazon’s business model.

INNOVATION

We might think that Amazon’s online store is their main business, but in reality it is just a fraction. They own Twitch, Whole Foods, Kindle, Alexa, Echo Dot, Amazon tap, fire tablets and TV, prime music, IMDb, good rates, and over 70 consumer brands we wouldn’t know that they own. Amazon doesn’t restrict itself, in fact hardly a month goes by where it doesn’t enter and dominate a new industry. They define their competitors as publishers, producers and distributors of physical, digital and interactive media, of all types and all distribution channels. That’s almost everyone. Although it seems like Amazon is scatterbrained because yesterday it wanted to conquer streaming video and today sell organic grapes in grocery stores. But in reality their ideas are increasingly creative: two day delivery? How about 2-hour delivery, a 3D smartphone, a flying warehouse complete with detachable drones, a grocery store without employees.

Their innovation strategy on sales and delivery channels, such as Amazon Echo and the kindle where you can both buy and receive books on your Kindle device is commendable.

MASSIVE SCALE

The essence of Amazon’s business model is that of scale. Before entering any new product, the question for Amazon is simple – Does it benefit from being 1000 times quicker, bigger, easier? And if so, Amazon either sells it or soon will. Amazon focuses more on the scale rather than the product and uses the cost advantage by making sellers compete with each other in the marketplace model.

LONG-TERM THINKING

Amazon seems to be using the snowball effect. 1st to get as many users as possible – give out $50 tablets, free shipping, license echo to every company willing. More users bring in more data which helps improve the product and the better product attracts even more users. They are not just making it easy to live off Amazon, they’re making it hard not to live without it. It may be losing money on the heaviest shoppers, but with 100 million of them, they’re winning a lot more than they’re losing. They are trying to put Amazon in your routine. They have come so far that they now compete with UPS and FedEx. It has already leased 32 Boeing 767 cargo jets, a massive cargo hub in Kentucky, and that’s just the beginning. The $79 Kindle costs more than what it sells for, but this is a calculated business decision.

At Amazon, the lack of profit isn’t just tolerated, it’s celebrated, because they would rather stop to make a dollar and wait to make five, which makes Amazon’s business model so special. It uses funds from AWS to fund projects like Kindle and Echo, which gives them the freedom to experiment.

AMAZON WEB SERVICES (AWS)

AWS is Amazon’s cloud computing division, comprising of a huge network of servers providing processing and storage solutions for companies, government agencies and individuals. What this has done for Amazon is turn it into a technology company as well as being an e-commerce retailer. It charges its clients such as Netflix, Airbnb and Yelp for their volume of usage, the features subscribe to, and the services they use. The big data collected by AWS is used for inventory management. By making use of predictive shipping, it avoids storing unnecessary inventory and being able to be a successful logistics partner as well.

It’s a highly profitable business by Amazon’s standards but by most corporate standards. Its earning 30 percent operating margins. In 2018, AWS brought in 7.3 billion dollars in operating income and 25.7 billion dollars in revenue which, for reference, is more than both McDonald’s and Macy’s. In this last quarter, AWS was 58 percent of total operating profit for the whole company. Hence it has become key it Amazon’s business model.

MARKETPLACE CONFLICT OF INTEREST

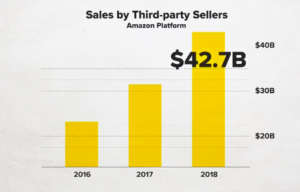

Originally, Amazon functioned as a retailer that typically buys goods from a manufacturer or wholesaler and then sells them in small quantities to the final consumer while getting its margin on top of the price. However, it made the risky decision to open up its market place to third-party sellers, which means that other businesses could display and sell their products on amazon.com. In this case, Amazon doesn’t own money by adding a margin but rather collect a fee from those third-party sellers. This creates a rather startling situation where merchants on Amazon marketplace can sometimes compete directly against Amazon itself.

Amazon can potentially see the data and when the spot particularly demanded items from these third-party sellers, they can create their own version of the same products, for example Amazon created the brand Amazon basics. Here, they benefit from data collected over the whole marketplace and then integrate vertically even more by going higher up in the value chain. This directly causes a conflict of interest in the marketplace and might harm competition in the long run.

AMAZON PRIME

Households have an Amazon prime account which allows them to benefit from fast shipping and access totally seemingly unrelated Amazon services such as prime video and music. Because of this convenience, 53% of all product searches start directly on Amazon. Products on Amazon getting prime delivery get more attention as it is more convenient, and hence the competition is severely hurt because prime is a service that encompasses so many different things that nobody can really measure the profitability of it. There is also a conflict of interest because Netflix uses Amazon’s AWS services, and Netflix is a direct competitor to Prime Video, so Amazon benefits from Netflix success as well.

CONTROVERSY

Amazon the faces serious legal challenges because they get access to the information of a third party sellers and it to their own benefit. The US house of representatives a bill called Ending Platform Monopolies Act to break some Amazon businesses. The European Union filed anti-trust charges against Amazon due to the same reason.

Amazon is helping to drive down prices by squeezing manufacturers and third-party sellers By taking over the market, it will eventually be able to raise the prices for consumers once again when there is not enough competition. This practice is called predator pricing. There is also a great deal of controversy about the way Amazon treats its employees. It has also been criticised for practises including technological surveillance overreach, hyper competitive and demanding work culture, tax avoidance, and anti-competitive behaviour.

REVENUE

Amazon reported record profits in 2018, earning $10.1 billion in net income compared to just $3 billion in 2017. Considering the company hardly had any annual profit until 2016, this represents major growth. Although Amazon has long dominated the US e-commerce market, online sales are not actually their biggest moneymaker. Its e-commerce division isn’t even profitable internationally. Instead AWS has generated a majority of the companies operating income since 2016. A large portion of its revenue also comes from the fees paid by third-party sellers as FBA or FBM fees. In 2020 Amazon’s ad business was worth almost $16 billion in the US. Amazon’s merchants be Amazon advertising fees to compete against other merchants and potentially Amazon itself.

In conclusion, yes, Amazon is the biggest and one of the most successful companies of all time, more so because it has reached the level it its at in a short amount of time. However, it is not devoid of malpractices and problems for the rest of the world.