Reinsurance is insurance for insurers. Reinsurance means when insurance companies sign an agreement to transfer their risk portfolios to other insurers to reduce the likelihood of paying large obligations from a claim. There are two types of reinsurance.

Moreover, the party that transfers or diversifies the insurance portfolio is the ‘ceding party’ and the party that accepts to share the risk and insurance premium is the ‘reinsurer’.

Examples of Reinsurance

Life Insurance

For instance, there are two insurance companies A and B. Mr X, a policyholder, has taken life insurance from company A worth ten lakhs. He pays a monthly premium of ₹10,000. In the case of life insurance, the principle of indemnity is not applicable. One cannot compensate for the loss of life in terms of money. Hence, on the maturity or the death of the policyholder, the insurer needs to pay the entire sum assured (in this case, it is ten lakhs).

Since maturity or the death of a person is certain, the insurance company is under the obligation to pay the claim amount in future. However, company A wishes to reduce its obligation. Hence, it signs a reinsurance contract with company B in the ratio of 3:2. Company A retains six lakhs and reinsures four lakhs with company B. Similarly, the monthly premiums also get distributed in the ratio of 3:2. Company A collects ₹10,000 from the policyholder and forwards ₹4,000 to company B. Remember, in the case of reinsurance, the policyholder is not involved.

On maturity or death of the policyholder, whichever is earlier, company A will collect four lakhs from B and contribute six lakhs of its own. Lastly, A pays ten lakhs to Mr X or the beneficiary.

General Insurance

Further, if the person had taken fire insurance of 10 lakhs for goods with company A, the monthly premium is ₹10,000. The company reinsures the policy with B in the same proportion 3:2. But in the case of fire insurance, the principle of indemnity is applicable. Hence, on happening of an unfortunate event like a fire, the compensation is up to the actual loss amount. If Mr X’s goods worth five lakhs were damaged, due to fire, the insurance company will compensate up to the actual amount of loss, and not the whole sum assured. Therefore, the insured will get a claim amount of 5 lakhs. Now, the compensation will also happen in the ratio of 3:2. Company A will collect two lakhs from B and contribute three lakhs of its own. Lastly, it will pay five lakhs to Mr X as the claim amount.

Types of Reinsurance

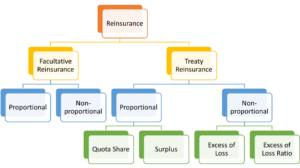

There are two types of reinsurance:

- Facultative Reinsurance

- Proportional

- Non-proportional

- Treaty Reinsurance

- Proportional

a. Quota Share

b. Surplus

- Non-proportional

a. Excess of Loss

b. Excess of Loss Ratio

For easy understanding, have a look at the flowchart showing the types of Reinsurance:

Facultative Reinsurance

It is one of the types of reinsurance done on an individual basis. There is a different reinsurance agreement for every insurance contract. Here, the ceding insurer may take many insurance contracts under the portfolio. But the reinsurer can accept or decline a specific risk from the entire risk portfolio of the ceding party.

Further, there are two types of Facultative Reinsurance:

- Proportional- The proportion of dividing the premium and claim of a specific risk is agreed upon while signing the reinsurance agreement.

- Non-proportional- There is no predetermined proportion to divide premiums and claims arising out of a specific risk. Here, the reinsurance amount depends on the amount of loss when the event occurs.

Facultative Reinsurance ensures flexibility. It allows insurers to negotiate separately for a certain type of risk in a specific area.

Previously, almost all insurance companies reinsured facultatively. But high administrative cost, difficulty, and delay paved the way for Treaty Reinsurance.

Treaty Reinsurance

In the case of Treaty Reinsurance, the reinsurer accepts all the risks of the ceding party or the original insurer automatically falling within the scope of the agreement. The reinsurer cannot decline any risk within the agreement range. A formal treaty includes the mode of operations, type of business, territorial limits, risk excluded, time of the agreement, premium and claim amounts, etc.

Since treaty reinsurance is automatic, the ceding party has the guarantee to receive reinsurance protection whenever he accepts a new risk within the scope of the agreement. It helps to reduce administrative costs. The renewal takes place regularly unless there is a change in the reinsurance agreement.

Further, there are two types of Treaty Reinsurance:

Proportional

The proportion of dividing the premium and claim of a specific risk is agreed upon while signing the reinsurance agreement. Further, it is of two types:

Quota Share

There is a predetermined proportion to share premiums and claims. For instance, company A signs treaty reinsurance with company B to reinsure all life insurance contracts. According to the agreement, 10% is direct insurance for company A, and 90% gets reinsured with company B. The premium received is ₹10,000. It also gets divided as per the proportion of 1:9. Company A retains ₹1,000 and forwards ₹9,000 to B. Since it is life insurance, the sum assured equals the compensation amount. Hence, company A collects nine lakhs from B, adds 1 lakh of its own, and pays ten lakhs to the policyholder.

Surplus

For example, the retention value for company A is ten lakhs, according to the reinsurance agreement. Retention value is the value for the direct business of the insurance company. So A retains whatever insurance policy up to ten lakhs, and the excess of ten lakhs of the policy amount will go towards reinsurance. If the policy amount is 30 lakhs- A retains ten lakhs, and reinsures 30 lakhs with B.

However, if there is a clause stating the maximum reinsurance limit, say 15 lakhs. Let’s say the policy contract is worth 20 lakhs. Company A will retain ten lakhs as direct business, and an excess of 10 lakhs will go towards reinsurance with B.

But if the policy contract is for 40 lakhs, with a 15 lakhs limit. So firstly, company B will provide 15 lakhs as the reinsurer and then A will retain the remaining 25 lakhs, irrespective of the retention value. In the case of maximum limit, retention value becomes irrelevant.

Non-proportional

There is no predetermined proportion to divide premiums and claims arising out of a specific risk. Here, the reinsurance amount depends on the amount of loss when the event occurs. Further, it is of two types:

Excess of Loss

Instead of the claim or premium amount, the agreement has the proportion for the loss. For instance, company A reinsures all its losses from public liability insurances with company B. They enter into an agreement where company A will bear losses up to the extent of ten lakhs. A will reinsure all losses over and above this limit, with a maximum limit of 8 lakhs with company B. So, if the loss is eight lakhs, A will compensate the loss as they will first cover up the losses up to ten lakhs.

Now, if the loss is 13 lakhs- Company A will cover up losses up to 10 lakhs, and B will bear the excess loss of 3 lakhs.

Moreover, if the loss amounts to 20 lakhs- B will cover up losses up to 8 lakhs, as per the maximum limit, and A will take the responsibility for the 12 lakhs loss, irrespective of the ten lakhs limit.

In surplus, the reinsurance was dependent on the maximum claim amount. But in the case of excess of loss, it depends on the loss on happening of an uncertain event.

Excess of Loss Ratio

It is also known as the Stop Loss Ratio. The insurance company determines a ratio based on the gross loss and gross premium received. Instead of dividing the amount as per the proportion, we directly divide the ratio, as per the agreement.

For instance, company A is the ceding company, and B is the reinsurance company. They enter into an excess of loss ratio reinsurance agreement that A will bear losses up to 60% of the gross premium, and B will cover up losses with a maximum limit of 80% (i.e., exceeding 60% but up to 80%).

If the premium collected is ten lakhs and the loss is seven lakhs. Hence, the loss ratio is 70% (7,00,000/10,00,000*100). Since the loss ratio does not exceed 80%, company A will bear losses up to 60% of the gross premium, i.e., six lakhs. Company B will bear the remaining 10% i.e., 1 lakh.

If the premium collected is ten lakhs and the loss is 8.5 lakhs. Hence, the loss ratio is 85%, exceeding the 80% limit. Firstly, company A will bear losses of up to 60% of the gross premium, which is six lakhs. Secondly, B will bear losses up to the remaining 20% (80%-60%), i.e., two lakhs. Lastly, A will cover up the remaining 5% of the loss ratio, which amounts to ₹50,000.