Warren Buffett is the CEO and largest stakeholder of Berkshire Hathaway, the investing firm that has grown its market value by 20% each year on average since 1965. Geico, Clayton Homes, and Dairy Queen are all owned by the Omaha, Nebraska-based corporation, which also has shares in Coca-Cola and American Express. Today, he is one of the richest people in the world and also one of the best investors of all time. Currently, Warren Buffett’s net worth is over $105.2 billion, making him the 10th wealthiest person in the world.

EARLY LIFE

Born on August 30, 1930, in Omaha, Nebraska, Warren Buffett is the second of three children. His father, Howard Buffett was a congressman. At a very young age, Buffett developed his interest in business and investing. At the age of seven, a book that he borrowed from the library – “One Thousand Ways to make $1000” – inspired him. After having lunch with someone from the New York stock exchange at the age of 10, Buffett decided that he wanted his life to revolve around investing.

He bought his first stock at the age of 11. His senior year book picture reads – “Likes math, a future stockbroker.” Buffett attended college at the Wharton school of the University of Pennsylvania. He then transferred to the University of Nebraska graduated with a BSc in Business Administration. After being rejected by Harvard business school, Buffett did his MSc in Economics from Columbia Business School in 1951.

CAREER

On graduating from Columbia, Buffett started working as an investment sales man in this family is company, Buffett-Falk & Co. Buffett’s business acumen got the attention of Benjamin Graham, who was a very respected investor and businessman, and one of Buffett’s former professors. Buffett then got his investment experience working as a securities analyst for the Graham–Newman Corp. On Grahams retirement, Buffett used the $174,000 that he had saved and started Buffett Partnership Ltd. In a span of three years, by 1962, he had become a millionaire and his business had grown from three partnerships to six. He then invested in, and eventually took over textile manufacturer Berkshire Hathaway.

Buffett embarked on a sequence of aggressive investments, takeovers, and restructuring actions that saw his assets skyrocket. He also established himself as an investor to watch and follow. Buffett had a talent for buying shares in firms that were grossly undervalued and riding the rise in their fortunes to ever-increasing profits. He was worth $620 million in the early 1980s and was nicknamed “Oracle of Omaha.” He made stock purchases in a variety of companies, including the Washington Post Company, Capital Cities, Salomon Brothers, and, most notably, the Coca-Cola Company. By 1990, Warren Buffett’s net worth had crossed a billion, and each stock of Berkshire Hathaway was worth $7175.

NET WORTH SUMMARY

Currently, Warren Buffett’s net worth is around $103 billion. To put this amount into perspective, his fortune is more than that of the GDP of Costa Rica. He could give every American $250 and still have a net worth in millions. With his wife, you could buy 1.35 billion barrels of crude oil or 57.9 million troy ounces of gold.

Buffett’s wealth is mostly generated from a 16 percent stake in Berkshire Hathaway. Since 1965, Berkshire has produced a 20 % yearly compounded increase in market value per share. Buffett holds around 39 percent of Class A shares and less than 0.001% of Class B shares. He has direct stakes in other companies as well. He holds about 5% of Seritage Growth Properties and less than 1% of Wells Fargo and U. S. Bancorp. However more than 98% of Warren Buffett’s net worth is represented by Berkshire Hathaway. His non-Berkshire stock portfolio consisted of $61 million in Wells Fargo and four $72 million in cash representing undisclosed shareholdings. Berkshire Hathaway is on its path to make over $12 million a day or half a million dollars an hour in dividends itself.

PORTFOLIO

The top 10 stocks held by Berkshire Hathaway, by value, are-

- Apple Inc. – $125.53 billion

- Bank of America – $42.88 billion

- American Express Company – $25.4 billion

- Coca-Cola – $20.99 billion

- Kraft Heinz Co – $11.99 billion

- Moody Corp – $8.76 billion

- Verizon Communications – $8.58 billion

- U.S. Bankcorp – $7.51 billion

- Davita Inc. – $4.20 billion

- Bank of New York Mellon – $3.75 billion

Some of his more recently added stocks are Alphabet, PayPal, Meta Platforms, Alibaba, Logitech International, Sprouts Farmer’s Market, Teradyne, Williams-Sonoma, Kroger and RH.

Buffett publicly admits that he has profited from a system that allows billionaires to pay extremely low tax rates, in part because income is taxed rather than wealth. He is well-known for drawing attention to the fact that he pays a lower tax rate than his secretary.

LESSONS WE CAN LEARN

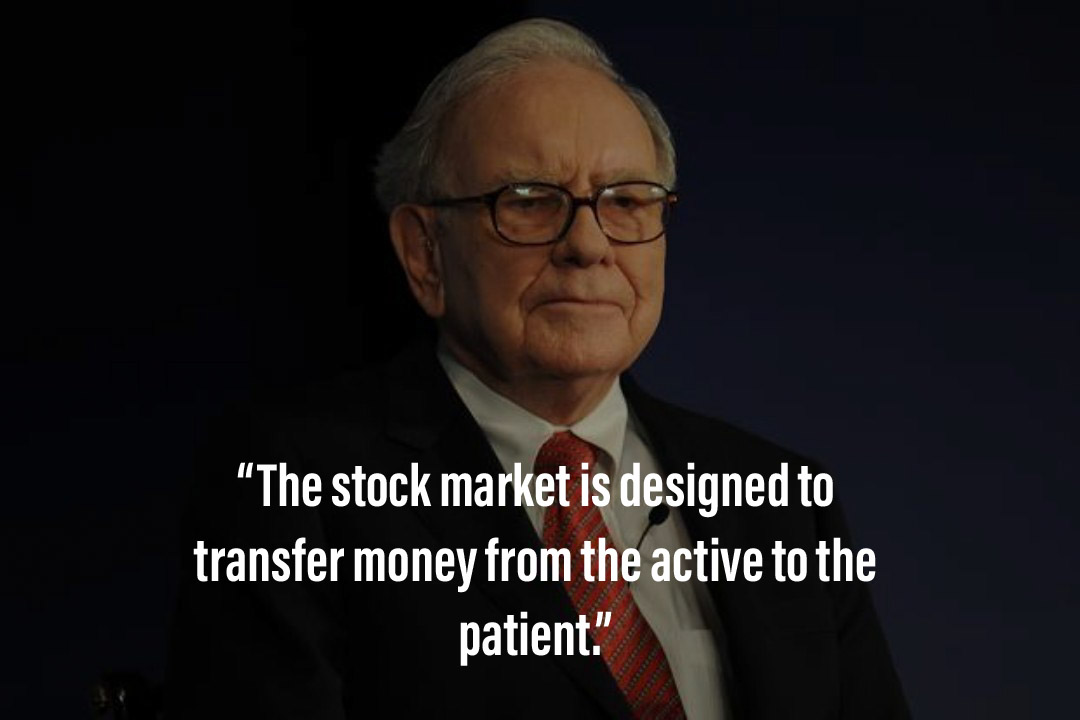

Buffett advises to buy stocks at bargain–basement prices and hold them patiently, so that you never have to count on making a good sale. Purchase price should be so attractive that even a mediocre sale gives good results.

He reads all of a company’s annual reports going back as long as he can when he invests in it. Buffett considers how far the firm has come and what its future plans are. He conducts exhaustive investigations and takes deliberate and infrequent actions. He is adamant about not selling a firm or shares in a company after he has bought them.

Another of his aphorisms reflects his preference for long-term investments: “You should invest in a business that even a fool can run, because someday a fool will.”He doesn’t believe in companies that rely on every employee being exceptional to succeed. Buffett advises us not to watch the market closely because the psychological effects can be dire. Instead of constantly checking to see whether you are up or down by a few percent, it is better to understand why you’ve made a particular investment, and then to trust it in the long run.

Advices was to keep it simple – to invest in businesses that have solid financials, a strong competitive advantage and good management. The company should own businesses with services that are always in need. With this in mind, he invested in banks, energy, and Amazon. He also holds the reputation of company to be very important and to only work with people you trust. Buffett strongly advises against borrowing money to buy stocks. He has infinite faith in investing, as his popular quote goes – “If you don’t find a way to make money while you sleep, you will work until you die.”

CONCLUSION

Buffett is a philanthropist and has pledged to give away most of his fortune on or before his death, a huge part of it going to the Bill & Melinda Gates Foundation. To date, he has donated more than $45 billion, the most of which has gone to the Gates Foundation and his children’s foundations. He started the Giving Pledge, which asks billionaires to pledge to donate at least half of their fortune to charity. He advises wealthy people to leave behind enough for the children to make something of themselves, but not so much did they end up doing nothing. We can all learn from Buffett’s simple lifestyle, his investment strategies, as well as his charitable endeavours!