Introduction

Cash Reserve Ratio (CRR) is the share of a bank’s total deposit that is mandated by the Reserve Bank of India (RBI) to be maintained with the latter as reserves in the form of liquid cash.

Base rate means the minimum lending rate below which a bank is not allowed to lend funds. The base rate is determined by the Reserve Bank of India (RBI). Cash reserve ratio is the ratio which helps in setting the base rate. The policy is largely influenced by the CRR, as it controls the money supply for an economy.

The cash reserve is either stored in the bank’s vault or is sent to the RBI. Banks can’t lend the CRR money to corporates or individual borrowers, banks can’t use that money for investment purposes. And Banks don’t earn any interest on that money.

Objectives

- Cash Reserve Ratio ensures that a part of the commercial bank’s deposit is with the Central Bank.

- While ensuring liquidity against deposits is the prime function of the CRR, it has an equally important role in controlling the interest rates in the economy.

- It helps in controlling inflation. Major economies face a a lot of Rate changes as the global inflation rate keeps on changing on a regular basis. During high inflation in the economy, RBI raises the CRR to reduce the amount of money left with banks to sanction loans. It squeezes the money flow in the economy, reducing investments and bringing down inflation and vice versa. Lowering the rate boosts the growth rate of the economy.

Why is Cash Reserve Ratio changed regularly

As per the RBI guidelines, every bank is required to maintain a ratio of their total deposits that can also be held with currency chests. This is considered to be the same as it is kept with the RBI. The RBI can change this ratio from time to time at regular intervals. When this ratio is changed, it impacts the economy.

For banks, profits are made by lending. In pursuit of this goal, banks may lend out maximum amounts, to make higher profits and have very little cash with them. An unexpected rush by customers to withdraw their deposits will lead to banks being unable to meet all the repayment needs.

The RBI controls the short-term volatility in the interest rates by adjusting the amount of liquidity available in the system. Too much cash in the economy leads to the RBI raising interest rates to bring down inflation, while the scarcity of cash leads to the RBI cutting interest rates, to stimulate growth in the economy.

CRR V/S SLR

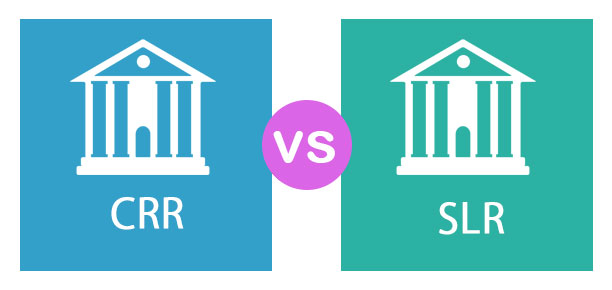

The RBI is required to keep the supply of money in the economy and for this purpose, it uses tools, like Bank Rate, Repo Rate, Reverse Repo Rate, Cash reserve ratio, and Statutory Liquid Ratio. The latter 2 are the form of reserves, in which the money is blocked in the economy and is not used for further lending and investment purposes.

- CRR is the percentage of money, which a bank has to keep with RBI in the form of cash. whereas, SLR is the proportion of liquid assets to time and demand liabilities.

- CRR is maintained in the form of cash while the SLR is to be maintained in the form of gold, cash, and government-approved securities.

- CRR regulates the flow of money in the economy whereas SLR ensures the solvency of the banks. The liquidity of the country is regulated by CRR while SLR governs the credit growth of the country.

- Through CRR, the RBI controls excess money flow in the economy whereas the SLR requirement ensures meeting out the unexpected demand of any depositor by selling the bonds.

- Cash Reserve Ratio – 4% (India)

- Statutory Liquid Ratio – 18% (India)

In short, CRR helps to regulate liquidity while SLR regulates credit growth in the economy

How does CRR works

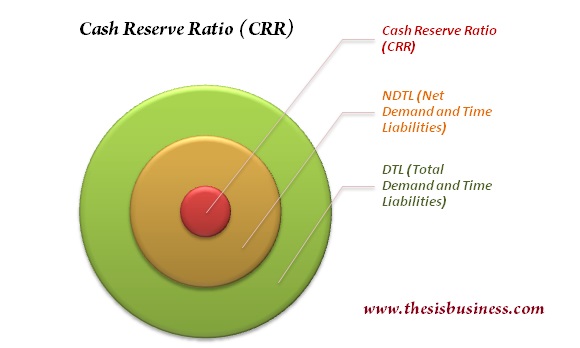

The cash balance that is to be maintained by scheduled banks with the RBI should not be less than 4% of the total NDTL, which is the Net Demand and Time Liabilities. This is done on a fortnightly basis.

NDTL refers to the total demand and time liabilities (deposits) that are held by the banks. It includes deposits of the general public and the balances held by the bank with other banks. Demand deposits consist of all liabilities which the bank needs to pay on demand like current deposits, demand drafts, balances in overdue fixed deposits and demand liabilities portion of savings bank deposits.

Time deposits consist of deposits that need to be repaid on maturity and where the depositor can’t withdraw money immediately. Instead, he is required to wait for a certain time period to gain access to the funds. This includes fixed deposits, time liabilities portion of savings bank deposits and staff security deposits.

The liabilities of a bank include call money market borrowings, certificates of deposit and investment in deposits in other banks. In short, the higher the Cash Reserve Ratio, the lesser is the amount of money available to banks for lending and investing.

CRR of the Major Economies

China – 11%

Brazil – 21%

Russia – 8%

India – 4%

USA – 0%

Turkey – 25%

How does CRR affect the economy

Cash Reserve Ratio (CRR) is one of the main components of the RBI’s monetary policy, which is used to regulate the money supply, level of inflation and liquidity in the country. The higher the CRR, the lower is the liquidity with the banks and vice-versa. During high levels of inflation, attempts are made to reduce the flow of money in the economy.

For this, RBI increases the CRR, lowering the loanable funds available with the banks. This, in turn, slows down investment and reduces the supply of money in the economy. As a result, the growth of the economy is negatively impacted. However, this also helps bring down inflation.

On the other hand, when the RBI wants to pump funds into the system, it lowers the CRR, which increases the loanable funds with the banks. The banks in turn sanction a large number of loans to businesses and industry for different investment purposes. It also increases the overall supply of money in the economy. This ultimately boosts the growth rate of the economy.

Conclusion

As the article clearly puts it that the CRR is a vital part of the monetary policy for the Indian economy. It controls the major part of the economy and it is changed regularly to control the abnormal situations of the economy.